CPI Aerostructures Reports Third Quarter And Nine Month 2025 Results

November 13, 2025

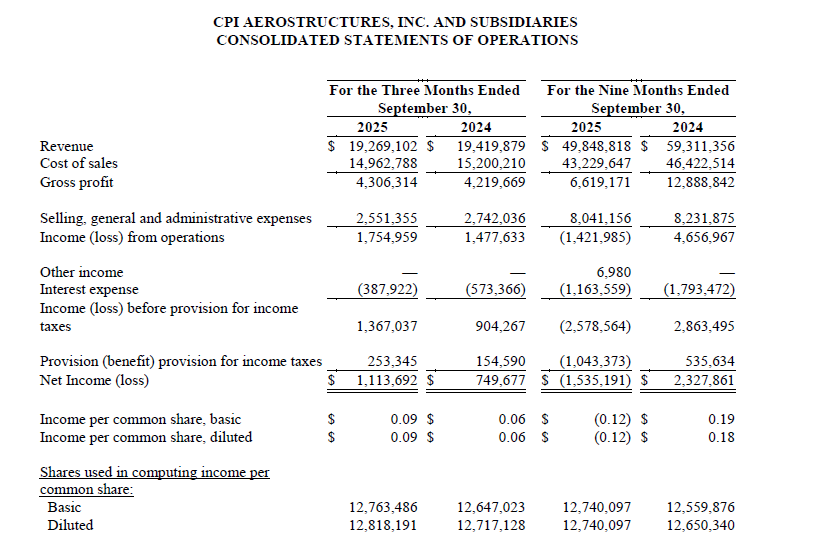

Third Quarter 2025 vs. Third Quarter 2024

Revenue of $19.3 million compared to $19.4 million;

Gross profit of $4.3 million compared to $4.2 million;

Gross margin of 22.3% compared to 21.7%;

Net income of $1.1 million compared to net income of $0.7 million;

Earnings per share of $0.09 compared to earnings per share of $0.06;

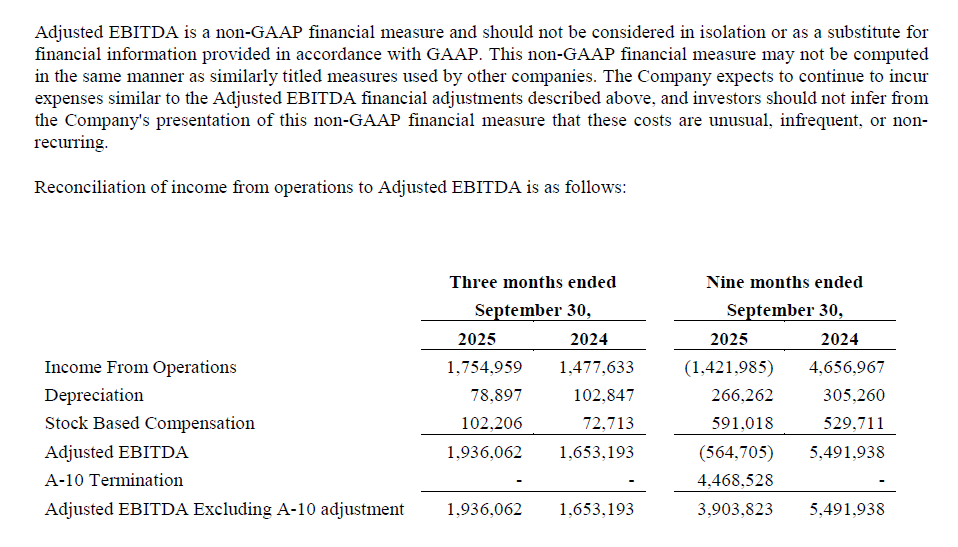

EBITDA(1) of $1.9 million compared to $1.7 million.Revenue of $19.3 million compared to $19.4 million;

Nine Months 2025 vs. Nine Months 2024

Revenue of $49.8 million compared to $59.3 million;

Gross profit of $6.6 million compared to $12.9 million;

Gross margin of 13.3% (20.4% excluding A-10 Program impact) compared to 21.7%;

Net (loss) income of $(1.5) million compared to net income of $2.3 million;

(Loss) earnings per share of $(0.12) compared to earnings per share of $0.19;

Adjusted EBITDA(1) of $(0.6) million ($3.9 million excluding A-10 Program impact) compared to $5.5 million;

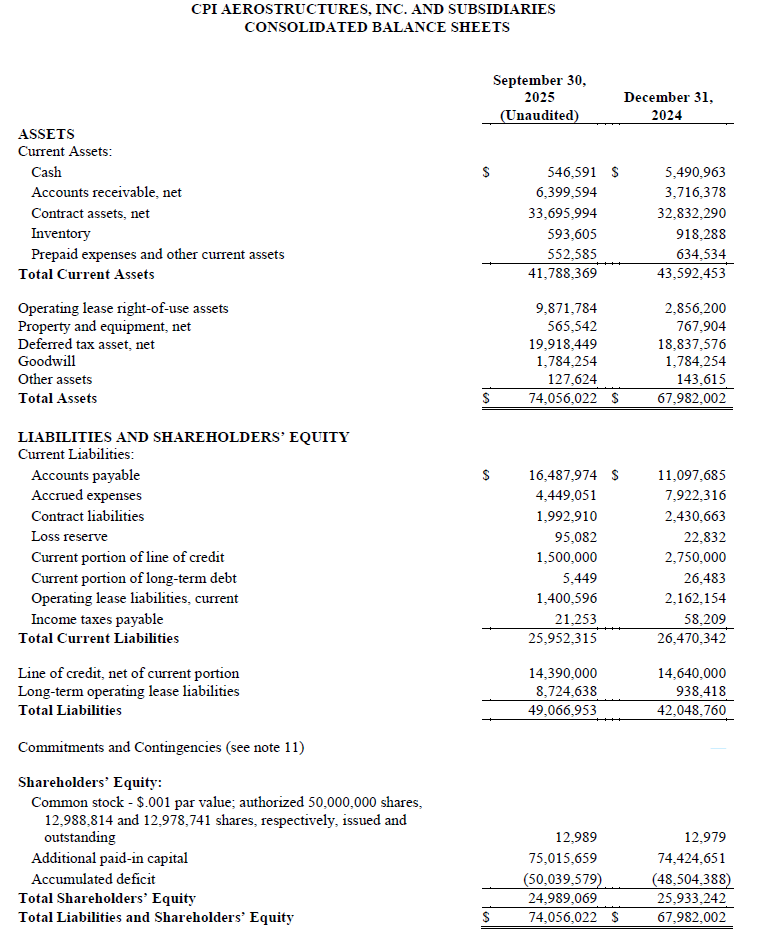

Debt as of September 30, 2025 of $15.9 million compared to $18.2 million as of September 30, 2024.

EDGEWOOD, N.Y. – November 13, 2024 – CPI Aerostructures, Inc. (“CPI Aero” or the “Company”) (NYSE American: CVU) today announced financial results for the three and nine month periods ended September 30, 2025.

“Our third quarter 2025 performance was stronger than third quarter 2024 on all fronts, with improved product mix and efficiencies resulting in 60 basis points gross profit margin increase and a 49% net income increase. In addition, our third quarter-adjusted EBITDA of $1.9 million is 17% higher than third quarter 2024. Our nine-month results remain affected by the Boeing A-10 Program termination impacts of the first half the year.

“We also continued to improve our balance sheet during the third quarter, bringing our total debt down to an all-time low of $15.9 million and our Debt-to-Adjusted EBITDA Ratio to 2.6 excluding the impact of the A-10 Program termination,” continued Dorith Hakim, President and CEO.

Added Ms. Hakim, “We are also pleased to receive an award from Raytheon, an RTX business, to manufacture structural missile wing assemblies for an undisclosed platform. This single source firm fixed price order with deliveries starting in 2026 represents a strategic win for CPI Aero, adding to our backlog of $509 million as of September 30, 2025. This award continues our success of winning new development programs and demonstrates the confidence top tier companies have in CPI Aero.”

About CPI Aero

CPI Aero is a prime contractor to the U.S. Department of Defense as well as a Tier 1 subcontractor to some of the largest aerospace and defense contractors in the world. CPI Aero provides engineering, program management, supply chain management, assembly operations and MRO services to this global network of customers. CPI Aero is recognized as a leader within the international aerospace market in such areas as aircraft structural assemblies, military advanced tactical pod structures, engine air inlets, and complex welded products. CPI Aero’s international customer

base enjoys a unique combination of large-company capabilities, matched with small-company value, responsiveness,

and personal customer service.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included or incorporated in this press release are forward-looking statements. The Company does not guarantee that it will actually achieve the plans, intentions or expectations disclosed in its forward looking statements and you should not place undue reliance on the Company’s forward-looking statements.

Forward-looking statements involve risks and uncertainties, and actual results could vary materially from these forward-looking statements. There are a number of important factors that could cause the Company’s actual results to differ materially from those indicated or implied by its forward-looking statements, including those important factors set forth under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the period ended December 31, 2024 filed with the Securities and Exchange Commission. Although the Company may elect to do so at some point in the future, the Company does not assume any obligation to update any forward-looking statements and it disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

CPI Aero® is a registered trademark of CPI Aerostructures, Inc. For more information, visit www.cpiaero.com, and follow us on Twitter @CPIAERO.

Contacts

Investor Relations Counsel CPI Aerostructures, Inc.

Alliance Advisors IR Pamela Levesque

Jody Burfening Interim Chief Financial Officer

(212) 838-3777 (631) 586-5200

cpiaero@allianceadvisors.com plevesque@cpiaero.com

www.cpiaero.com

-Tables to Follow-